VND interbank interest rates "downhill"

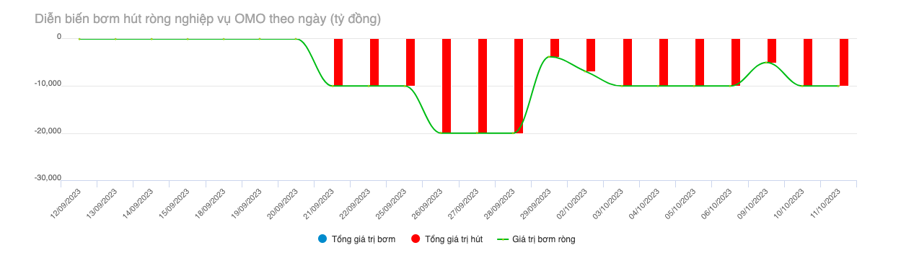

The overnight VND interbank interest rate decreased by half compared to the peak session on October 5. Through 15 sessions, the State Bank net withdrew VND 165,695 billion through 28-day bills. The winning interest rate for T-bills decreased from the highest level of 1.3%/year to 0.68%/year in the latest session...

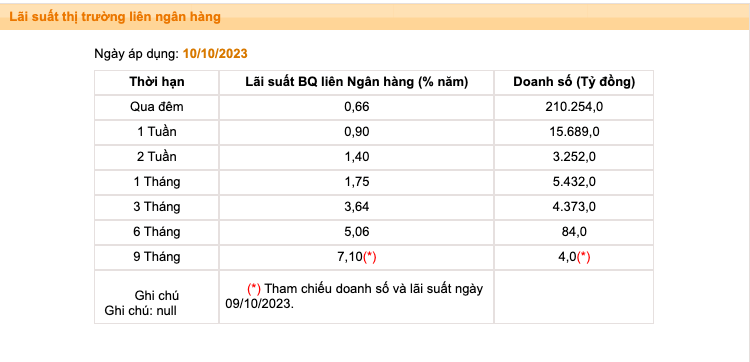

According to the latest data announced by the State Bank, the average VND interbank interest rate for overnight term on October 10 session is only 0.66%/year.

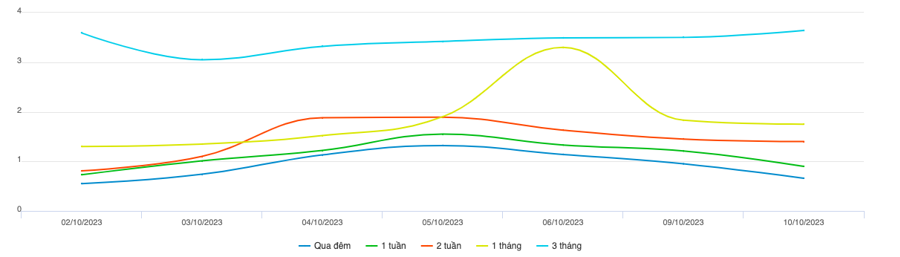

Previously, the State Bank said that in the week from October 2 to 6, the average interbank interest rate increased compared to the previous week at most terms. Specifically, the average interest rates of some key terms such as overnight, 1 week and 1 month increased by 0.8%/year, 0.88%/year and 0.34%/year, respectively, to 0.97. %/year, 1.24%/year and 1.64%/year.

Particularly, in the October 5 session, VND interbank interest rates recorded the highest level in recent months. Specifically: overnight interest rate 1.32%; 1 week 1.55%; 2-week term 1.89%; 1 month term 1.9%.

Thus, compared to the session on October 5, the VND interbank interest rate on October 10 has decreased very deeply.

Meanwhile, for USD transactions, the average interbank interest rate is relatively stable. Specifically, the average interest rates for some key terms such as overnight, 1 week and 1 month remained at 5.04%/year, 5.06%/year and 5.38%/year.

In the context that USD interest rates remain high, the decline in VND interest rates causes the interest rate difference between these two currencies to widen, putting pressure on the exchange rate.

From October 9 to October 11, the State Bank continued to attract VND through T-bill bidding. The total value of treasury bills issued in 3 sessions is nearly 24,000 billion VND. However, the winning interest rate has decreased from 1%/year (9/10) to 0.68%/year in the remaining 2 sessions.

The above indicators show that system liquidity is still in excess.

According to updates from market analysis reports, as of September 20, 2023, M2 (money supply) increased by 4.75% compared to the beginning of the year (last year 2.49%), mobilization increased by 5.8%. (last year: 4.04%) and credit increased by 5.75% (last year: 10.54%).

Thus, in the last months of 2023, the State Bank must handle three difficult problems: exchange rates, inflation and excess liquidity while credit growth stagnates.

The State Bank has made moves through the bill issuance channel to find the optimal balance between exchange rates and interbank market interest rates, while limiting the impact on market interest rates 1.

In September, overall inflation recorded the third sharp increase in a row, increasing by 1.08% over the previous month and 3.66% over the same period. The biggest contributors to CPI in September were gas prices (+8.37% over the previous month), rice prices (+4.2%), gasoline prices (+3.54%) and house rental prices (+0, 6%).

In the third quarter, inflation increased by 2.89% over the same period, of which house rent (+28.5% over the same period) was the factor that had the biggest impact on CPI, besides food and education prices. This is also the factor that causes core inflation to remain high in the first 9 months of the year (+4.5%).

Pressure on core inflation remains high as the producer price index (PPI) of

services increased by 7.34% over the same period, and from there, there may be a pass-through effect to the service price index group. . For overall inflation, fluctuations in gasoline prices are a risk factor. The positive point is that the average CPI in 9 months only increased by 3.2% over the same period - much lower than the Government's target of 4.5%.

On October 11, the USD/VND exchange rate on the interbank increased by about 40 VND to 24,450 - 24,460 (buying - selling), partly influenced by the sharp increase in the exchange rate on the free market.

The USD/VND exchange rate increased sharply in September (+3.1%) in the context that the USD also recorded an increase of 3.2%. Since the beginning of the year until now, USD/VND has increased by 2.8% - compared to 2.6% for DXY.

The USD strengthened significantly in the third quarter thanks to expectations that the Fed would keep interest rates high for a longer period of time, and put greater pressure on the VND when the State Bank is implementing a loosening monetary policy to growth support.

Some positive information supporting the exchange rate is the disbursed FDI capital flow in 9 months (reaching 15.9 billion USD) or the trade balance maintaining a surplus of 21.7 billion USD.

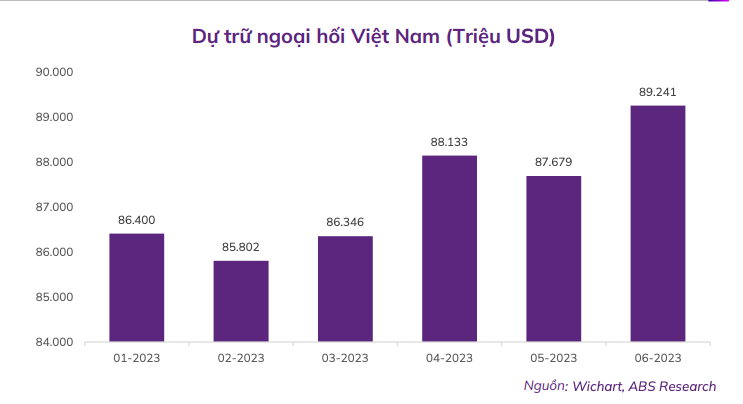

According to updated data from ABS, by the end of June 2023, Vietnam's foreign exchange reserves are about 89 billion USD. It is expected that in 2023, the total value of reserves may exceed 100 billion USD thanks to import-export activities maintaining a trade surplus and FDI capital increasing sharply.

Post a Comment