Correct the "gold and brass" situation in consumer lending

After a period of rapid growth, consumer credit has plummeted since the second half of 2022 until now. Lenders reflect that this is a special time because credit has decreased sharply and bad debt has increased. Many opinions believe that it is necessary to soon close legal loopholes on debt recovery and separate regulations on bad debt control and capital adequacy ratios of consumer finance companies from those of commercial banks to be more consistent with the needs of consumer finance companies. This particular type of finance....

According to data from the General Statistics Office, in the first 9 months of 2023, on average each month, 15,000 businesses will withdraw from the market, leading to unemployment and a sharp decline in workers' income. Since then, consumer demand has bottomed out, leading to difficulties in the consumer finance sector through sluggish sales of large retail chains nationwide.

According to Mr. Le Quoc Ninh, Chairman of the Consumer Finance Club, Vietnam Banking Association, despite the improvement in revenue of retail chains in the second quarter, the retail market in Vietnam still has low Negative revenue growth over the same period in the first half of 2023, reflected in the decline in net revenue of three retail giants: Mobile World, Dien May Xanh and FPT Shop.

After two consecutive quarters of decline, the motorbike market regained growth momentum in the third quarter of 2023, however, the increase was quite slow and the total number of motorbikes sold on the market was still lower than the same period last year.

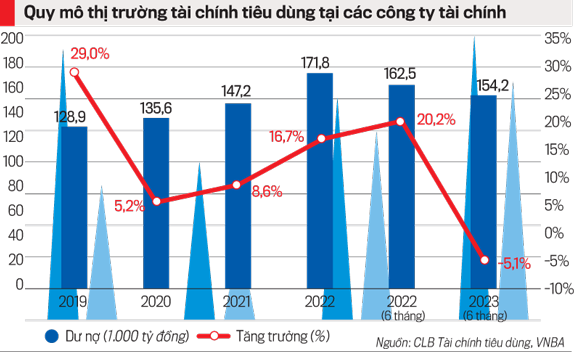

For consumer finance companies, in the first half of 2023, outstanding loans decreased significantly with a decrease of 5.1% compared to the same period in 2022 and 10.2% compared to the end of 2022.

In addition, the explosion of unofficial consumer loan apps or "black credit" with high interest rates and unethical and legal debt collection methods makes society understand mistakenly, equating consumer credit with "black credit".

“There are currently 16 mainstream consumer finance companies licensed by the State Bank and managed by a strict legal framework, but there are hundreds of lending apps operating online. These subjects counterfeit websites, logos, and brand names of mainstream banks and financial companies in a very sophisticated manner. We had to issue many warnings about individuals impersonating the company to fraudulently appropriate customers' assets," Mr. Ninh said.

DIFFICULT IN RECOVERY, ALARM OF INCREASING BAD DEBT

According to Major Nguyen Ngoc Son, Criminal Police Department, Ministry of Public Security, loans on consumer apps seem very small, only 1.5 million VND to 3 million VND, but the interest and fees are very high. Due to high interest and fees, borrowers are lured by borrowers into using one app after another to pay off old debts, leading to debt piling up.

“Once borrowing money from these apps, the borrower is forced to mortgage personal information; information in the phone book, so there is an extremely high risk of personal information being leaked. App loan lenders will transfer borrowers' personal data to "gangster" debt collectors to terrorize the borrower's relatives, friends, and colleagues; causing loss of social order and safety," Mr. Son informed.

According to FiinGroup, bad debt of financial companies also increased from 10.7% at the end of 2022 to 12.5% at the end of June 2023.

A representative of the Vietnam Banking Association said that the bad debt ratio has not stopped there, and continues to increase because the "debt boom" is increasingly rampant.

Lawyer Nguyen The Truyen, City Bar Association. Hanoi, believes that in addition to the serious decline in people's income causing them to lose their ability to repay debt, the rise of fake consumer loan apps is also one of the causes of the debt explosion. Debt fraud arose. Because, borrowers understand that unofficial and fake loan apps will never be able to sue or request to handle the borrower according to the law, but only make threatening calls...

According to Mr. Nguyen The Truyen, financial companies that want to lead the market must let the market know who they are. Especially in today's digital technology age, these companies must have specialized professional departments to check every day for fake websites or imitations of their brands. This review must be done up to the minute to prevent; Give early warnings to customers.

Consumer finance companies must also send information of fake subjects to the Fake News Prevention Center of the Ministry of Information and Communications so they can handle fake websites and apps...

NEED TO ALLOW PROFESSIONAL DEBT RECOVERY TO OPERATE

Agreeing with Lawyer Truyen, Major Nguyen Ngoc Son emphasized that banks, credit institutions, and financial companies must also strengthen the provision of propaganda and technology solutions so that people can distinguish between credit and credit. official credit and what is "black credit". At the same time, communicate from operating methods to all forms of lending. Formal lenders must also try to control loan purposes; must be for consumption and not loans for illegal activities, such as gambling.

“Currently, we are promoting cooperation with the banking industry in authenticating borrower information based on population data; authenticate SIM and phone number; Avoid the situation where the borrower falsifies information. Thereby, financial companies also have initial information to evaluate the borrower's credit, limiting the debt explosion situation," Major Nguyen Ngoc Son emphasized.

Lawyer Nguyen The Truyen said that the law already has legal regulations to handle acts of debt default and debt default. The most serious is criminal prosecution for abuse of trust and appropriation of property. Anyone who borrows and deliberately does not pay back even a few million dong is at risk of being criminally prosecuted.

“I believe that of the 16 officially operating consumer finance companies, none have used the courts to recover their debts. Because consumer loan debts are very small, while the costs in terms of money, time, and personnel for a court hearing to decide on a sentence are too long...", Lawyer Truyen said.

Mr. Truyen suggested that Vietnam currently has nearly 40 jurisdiction centers, they operate similarly to businesses and are fully competent to resolve disputes related to credit contracts. This jurisdictional center can issue judgments. Even though consumer loans are only a few tens of millions of dong, if anyone fails to repay the debt, there is always a judgment hanging over their head. This is also the basis for financial companies to handle the borrower's assets at any time. If there is money in the borrower's account, it can be immediately distrained.

But according to him, in the long term, the authorities need to research and build a legal corridor to allow professional debt collection activities to operate again.

In fact, according to the Investment Law 2020, debt collection activities are prohibited in Vietnam, but in other progressive markets, this activity is allowed based on a clear legal framework. If consumer finance companies build their own debt collection teams, it will be a waste of resources and ineffective. In an area where there are several reputable debt collection companies operating, providing services to dozens of consumer finance companies, it will obviously save a lot of resources.

According to Dr. Can Van Luc, Member of the National Financial and Monetary Policy Advisory Council, consumer lending from financial companies is very different from lending from commercial banks. Each of these groups of organizations has different risk appetite; different business processes.

“Financial companies target subprime banks. Obviously, sub-standard customers are the first to be affected when the economy becomes difficult. Experience shows that when the economy is difficult, the two types of outstanding debt that are most likely to become bad debt are consumer loans and credit cards," Mr. Luc said.

NEED TO SPECIFIC RISK CONTROL REGULATIONS FOR CONSUMER FINANCE COMPANIES

Stemming from the above differences, Mr. Luc recommends that state management agencies need to have separate regulations on bad debt control and capital adequacy ratios for consumer finance companies, not to equate them with commercial banks. because it is clear that the risk appetite and credit limits of these two groups are completely different

Post a Comment